- Heavy hammer Mobile Crusher 66

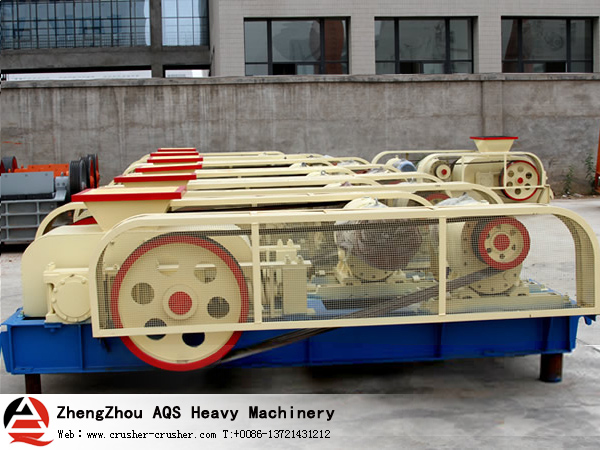

- Roll Crusher 547

- Composite crusher 338

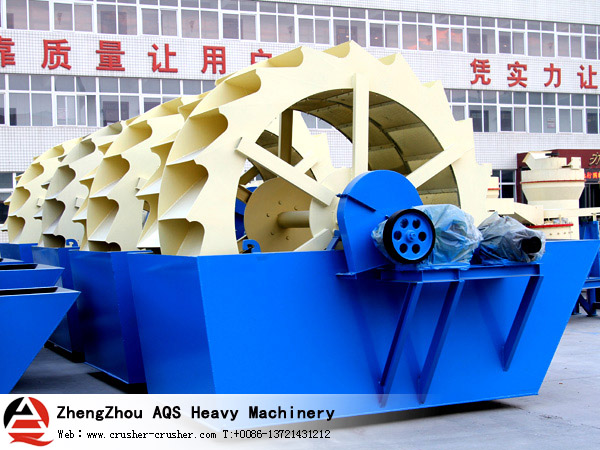

- Wheel Sand Washer 227

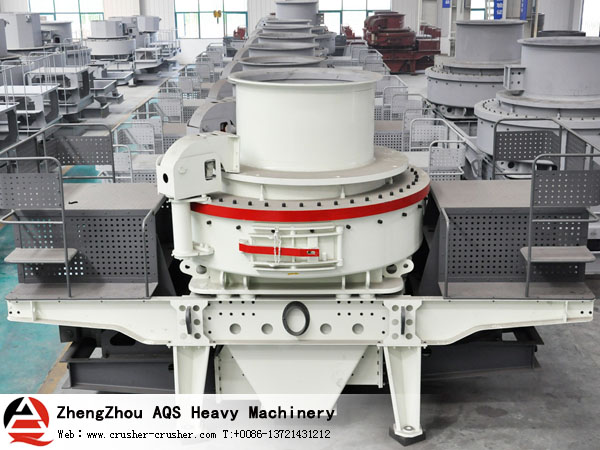

- VSI Sand Maker 209

- Sand recycling machine 126

- Super Ultra-fine Mill 245

- Powder Concentrator 214

- Belt Conveyor 331

- Sand Washer 124

China, the biggest soybean buyer, boosted imports by 29 percent to a record in 2010 as the domestic crushing industry expanded to supply higher consumption of livestock feed and cooking oil.

Purchases were 54.8 million metric tons last year, including 5.43 million tons last month, the Beijing-based customs office said on its website. China is forecast to account for almost 60 percent of global trade of the oilseed, the U.S. Department of Agriculture said Dec. 10.

A shift toward a diet richer in meat and oil, fueled by higher disposable incomes, drew increased investment in the oilseed-crushing industry, which is expected to grow by about 18 percent in capacity to more than 100 million tons this year, according to the China National Grain & Oils Information Center. China last year overtook Japan to become the world’s second- largest economy, the International Monetary Fund said.

“While the growth in consumption is phenomenal, the expanding industry is also buying up more of the suppliers’ inventory and stocking them here in China,” said Chen Baomin, an analyst at Jilin Grain Group Co., by phone from Dalian. The government also added a few million tons of local soybeans to its reserves, he said.

China’s ending stocks of soybeans on Sept. 30 were estimated to be 14.5 million tons, a 60 percent surge from the level of a year ago, according to the Dec. 10 USDA forecast.

“The pace of purchases going forward is slowing, given the negative profit margins experienced by crushers now,” Chen said. While many crushers pre-bought a significant portion of this year’s supply, they won’t make additional purchases if profits don’t improve, he said.

A crusher needs to pay about 4,500 yuan ($679) for a ton of soybeans, and earns less than 4,300 yuan from selling the crushed products, including soybean meal and oil, Chen said.

Buying behavior can also change by the nature of the market, Chen said. “In a bull market, buyers will overlook the inventory factor, but if the market gets bearish, people will notice more the piling-up of stocks.”